How user experience research can improve CDR & Open Banking outcomes

If you could visit a website called savememoney.com—where you could securely log in and press a button to see places where you could save money—would you do it?

What if you wanted to move accounts between banks, and all you had to do was press a button that would automatically check your credit history, approve you, transfer your money, and set up your new accounts?

While these opportunities don’t yet exist, they’re aligned with the vision of Open Banking under the Consumer Data Right (CDR) in Australia. Although consumer awareness of Open Banking is currently limited, individual organisations across sectors have a great opportunity to get in at the ground floor with new marketing strategies and technology by building on a strong foundation of user experience (UX) research.

What is the Consumer Data Right (CDR)?

The Consumer Data Right (CDR) is a foundational framework that aims to give consumers greater control and access over their personal data. According to the Australian Competition & Consumer Commission (ACCC), CDR will “improve consumers’ ability to compare and switch between products and services,” as well as to, “encourage competition between service providers, leading not only to better prices for customers but also more innovative products and services.”

There are two primary types of participants under CDR:

- Data holders, which hold consumer data.

- Data recipients, which receive consumer data in order to provide a product or service.

Data holders are required to remain in compliance with active CDR standards, while data recipients must earn an accreditation that proves they’re able to receive and manage consumers’ personal data in a way that meets CDR requirements.

What is Open Banking?

Although CDR was first introduced in November 2017, its official deployment began in July 2020 in the banking sector (referred to as ‘Open Banking’).

A Phased Approach

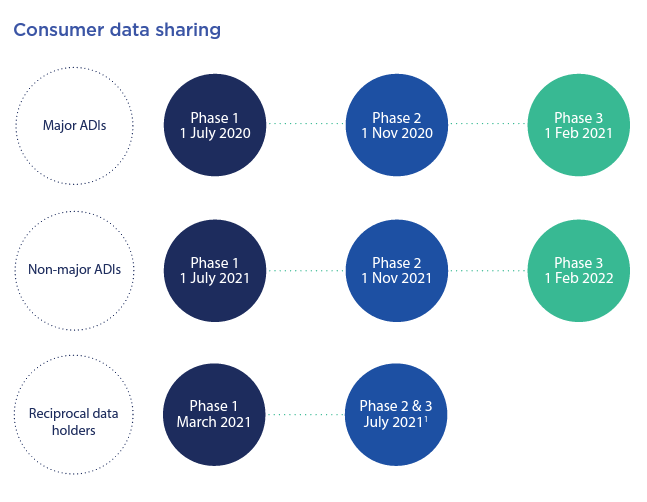

Since July 2020, Open Banking has been rolled out in a phased approach, with specific deadlines dictated by data type (i.e. consumer data sharing vs. product reference data), participant type—including the major authorised deposit-taking institutions (ADIs), non-major ADIs, and reciprocal data holders—and product type:

- Phase 1: Including savings accounts, call accounts, term deposits, current accounts, cheque accounts, debit card accounts, transaction accounts, personal basis accounts, GST or tax accounts, personal credit or charge card accounts, and business credit or charge card accounts.

- Phase 2: Including residential home loans, investment property loans, mortgage offset accounts, and personal loans.

- Phase 3: Including, overdrafts (personal and business), business finance, investment loans, lines of credit (personal and business), asset finance, cash management accounts, farm management accounts, pensioner deeming accounts, retirement savings accounts, trust accounts, foreign currency accounts, and consumer leases.

In addition, a number of amendments have been introduced to the CDR ruleset in order to ease participation since its initial rollout.

The State of Open Banking

As of this writing, major ADIs and reciprocal data holders have completed all three phases of their consumer data-sharing rollouts, with non-major ADIs set to finish in February 2022:

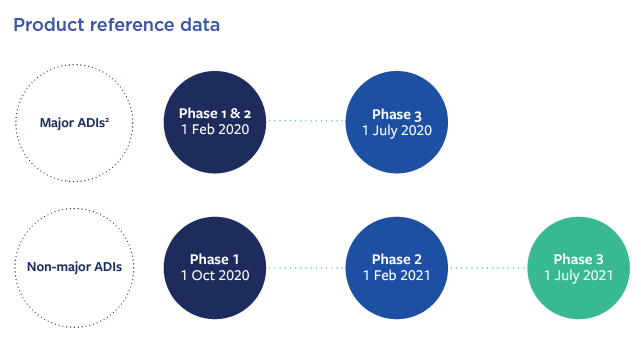

Institutions of all types have also completed all of the scheduled phases of their product reference data rollouts:

At a more granular level, Frollo’s State of Open Banking 2021 research reports that, as of November 2021:

- 75 banks, including major ADIs and non-major ADIs data holders, allowed customers to share their data

- There are 19 ADRs in the CDR registry, including nine Open Banking solution providers, six banks (including three of the Big Four), and four consumer platforms and B2B providers.

- 92 per cent of the 131 financial institutions surveyed plan to use CDR data, with 62 per cent planning to do so within the next 12 months

Despite this growing interest and adoption, Open Banking poses a challenge to many different sectors—especially when it comes to targeted marketing. After all, if people start owning their own data and restricting access to it, how can organisations run loyalty programs or extend personalised offers? How can they do marketing at scale, at all?

How Different Types of Organisations Can Leverage Open Banking

In part, success under Open Banking is likely to come down to educating consumers on the value of opening up access to their data. As the access to user behaviour tracking by third-party and secondary cookies continues to decline, it’s becoming harder and harder to know what people are spending their money on—and how to market to them accordingly.

Under Open Banking and CDR, organisations can ask consumers to share their data and then give them targeted offers based on it. But for this to happen, organisations must connect the dots for users that the value of Open Banking is in making their data work for them—in being able to receive contextual offers based on their actual spending, as opposed to what they might have clicked on while they were wandering around the internet.

Beyond increasing adoption, here are some of the current considerations being undertaken by different sectors:

The Banking Sector

There are two things being talked about in the banking sector when it comes to Open Banking. The first is how to be in compliance with specific regulations, but the next level—where the battleground really is—is how to compete. Because everyone’s had to comply at this point, firms can actually compete using Open Banking data by coming at future campaigns from a user experience (UX) point of view.

Essentially, this means recognising that, although the data is there, it doesn’t necessarily tell us what the customer needs. What’s their persona? What’s their life stage? If we can identify what life stage customers are at through UX research, we can figure out what services and products Open Banking could help them with.

For example, at Sitback, we’re currently working with a small bank that’s focused on providing banking services to people in the armed forces who have access to government-subsidised mortgages. But because people who join the military are often quite young, they aren’t really thinking about buying homes when they first enlist—and they tend to sign on with whatever large bank they’re most familiar with at that point.

But when they come out of the armed services at age 30, smaller banks could assess their data and provide them with targeted offers at better rates—even helping them to move their accounts over. Along the same vein, large banks could conduct a similar assessment to communicate the value of long-term banking relationships to this audience segment.

Ultimately, whether the priority is new customer acquisition or the retention of existing customers, it’s less about the technology or the specifics of Open Banking and more about understanding the trigger points that get people to make a decision.

Fintechs

In an Open Banking world, smaller banks can compete by developing their challenger pitch and pinching a little bit of work off the big banks, while the big banks can use consumer data to entice customers to stay with more targeted offers.

But, realistically, there’s a good chance that the banks themselves may be slow to develop competitive Open Banking products with stable APIs—and that leaves the door open to fintechs that target certain audiences and build technology around them that they then sell to the banks, big or small.

As an example of what this might look like, take Verrency, which effectively plugs a secure marketplace into the banks and then allow fintechs to drop their technology into the marketplace.

According to Jeroen van Son, CEO at Verrency, “The changes we expect to see have been a long time coming. Big Tech has educated consumers over the past decade to expect highly personalised and relevant offers and communication.” Technology like Verrency, he continues, could enable “banks to innovate at the speed of light and to hyper-personalise financial products and services, all without having to make costly, complex and time-consuming changes to existing banking systems”.

Government Agencies

Although they aren’t attempting to make more targeted offers to consumers, Australian government agencies face a similar challenge: communicating the value of CDR not just in terms of Open Banking, but in future phases, which will see similar changes made to utilities and telcos.

Jessica Robinson, the Assistant Secretary of the CDR Policy and Engagement Branch in Treasury, states that, “In the past six months we’ve seen a significant increase in the number of businesses becoming accredited under the CDR and looking to offer consumers new services that leverage their banking data, including bill management services. But the CDR is not stopping there – it’s expanding to apply to general insurance and superannuation, as well as non-bank lending and merchant acquiring service providers.”

Additionally, she notes that, “From November, energy data will be available through CDR to help consumers better understand their energy usage and whether they’re on the best energy plan. Rules and standards will also be made to extend the CDR to telecommunications data. As our Minister, the Hon Jane Hume MP, has said, ‘the CDR is not a finite end point – it’s an ongoing process’. And that process will continue to evolve, with the impact and value of the CDR increasingly felt across the Australian economy.”

Interestingly, these next phases may be more successful—particularly amongst people who think that Open Banking is too hard to grasp. Maybe they don’t want to move their mortgage, but they might be open to moving their phone bill. Here, CDR implementation could make comparing phone plans—with their different service offerings and obtuse language—as simple as clicking a button to enrol with a new provider.

UX research can help here as well. For example, the research we could do at Sitback might find that changing a mortgage is such a big deal that most consumers want to take the decision to a broker or financial advisor. But maybe swapping out their phone bills or gas and electricity bills is easier to stomach.

With that data, we may be able to confidently suggest that the implementation of CDR outside of banking is where consumers are willing to start moving—and then, in 3-4 years, they’ll feel comfortable moving other financial instruments this way.

How Sitback Can Support Organisations on Their CDR Journey

As a behavioural design and UX consultancy rooted in human psychology, the first way we can support organisations is through core research that understands what’s going on in the minds of their target customers. From there, we can map out a journey related to the organisation’s product—and in the end, we might build a new resource, asset, or campaign that helps communicate this new messaging.

For example, one challenge facing the Australian government is simply how to get the word out there about Open Banking. Rather than simply churning out broad marketing messaging, the UX approach would be to start by identifying who they think their top 6-8 target personas are. Is it young professionals? People starting a family? Retirees? Whatever the specific life-stage personas are, we could then perform qualitative research to determine who’s most likely to be interested in Open Banking and what they care about.

In this instance, we might find that there’s no point in trying to educate a young couple who’s busy starting a family on data rights. But at the same time, we might find that retirees have time on their hands, money in the bank, and a vested concern in making the most out of their savings. None of these might be true, but UX research is what will help organisations identify not just the right personas to target, but also the trigger messages that will get them to take action on Open Banking.

Geoff Wenborn, CIO at IT Board Advisory, emphasises how important it will be for organisations to take a customer-centric approach through UX and customer experience (CX) work. “Technology is key. However, without a CX lens, then it may end up being technology for technology’s sake”, he states.

Wenborn, who is helping a number of financial institutions plan for a future where personal data ownership shared with consent has real value, currently sees a lot of mandatory investment and perception of regulatory overhead across the industry, but not enough customer take-up or organisational benefit from new product offerings flowing. “No doubt some early adopters or evangelists may be seeing stronger engagement with Open Banking,” he concludes. “But unless you make it a great consumer experience, any real value sits idle.”

To learn more about how Sitback can help your organisation support Open Banking and CDR rollouts without compromising your customers’ experience, get in touch with our team directly.